Introduction to Cryptocurrency Market

The cryptocurrency market has rapidly evolved from a niche segment of the financial world to a widely recognized investment option. Cryptocurrencies, digital or virtual currencies that use cryptography for security, have garnered significant attention due to their decentralized nature and the potential they offer for impressive returns. Bitcoin, the first and most well-known cryptocurrency, was introduced in 2009 by the pseudonymous Satoshi Nakamoto and has since paved the way for thousands of alternative digital currencies.

At its core, cryptocurrency operates on a technology called blockchain, a decentralized ledger that records all transactions across a network of computers. This eliminates the need for a central authority, ensuring transparency and security. The allure of control, censorship resistance, and the potential for high returns has driven a diverse array of investors into the crypto market, ranging from individual hobbyists to large institutional players.

Understanding the market dynamics is crucial for anyone looking to invest in the crypto market. The price of cryptocurrencies can be highly volatile due to factors like regulatory news, technological advancements, market sentiment, and macroeconomic trends. While some investors have achieved substantial gains, others have faced significant losses. Therefore, comprehending both the potential for high returns and the risks involved is essential before diving into cryptocurrency investments.

The importance of a well-rounded understanding of the cryptocurrency market cannot be overstated. Investors need to educate themselves about the various types of cryptocurrencies, their underlying technologies, and the external factors that could influence their valuations. With knowledge and strategic planning, the vast opportunities within the cryptocurrency market can be navigated effectively.

Investing in Cryptocurrencies

The landscape of investing in cryptocurrencies offers several strategies that cater to varied risk appetites and investment horizons. One of the most widely adopted approaches is buying and holding, often referred to in the crypto community as “HODLing.” This strategy involves purchasing cryptocurrencies and holding onto them for an extended period, hoping the value will increase as the market matures and adoption grows. HODLing can be particularly effective for long-term believers in the potential of blockchain technology and digital currencies. However, it requires patience and a strong conviction, as the market can be exceedingly volatile.

In contrast, trading on exchanges provides an alternative strategy, relying on short-term price movements to generate profits. This method involves actively buying and selling cryptocurrencies on various exchanges, aiming to capitalize on market fluctuations and trends. Trading demands a keen understanding of market indicators, technical analysis, and a sharp eye for timing entry and exit points. While potentially lucrative, it also carries higher risks and requires constant monitoring and analysis of the market.

Regardless of the chosen approach, selecting the right cryptocurrencies is paramount. Investors must conduct thorough research into the projects and teams behind potential investments. Evaluating the purpose and utility of the cryptocurrency, the leadership team’s experience and track record, partnerships, and the community’s strength plays a crucial role in making informed decisions. Due diligence can mitigate the risks associated with fraudulent or ultimately unsuccessful projects.

Moreover, diversification remains a critical principle in investing. Spreading investments across multiple promising projects can reduce risk while providing exposure to various opportunities within the cryptocurrency market. Balancing between established cryptocurrencies like Bitcoin and Ethereum, and newer, promising tokens can help navigate the dynamic crypto landscape effectively.

Trading Cryptocurrencies

Trading cryptocurrencies involves buying and selling digital assets on various exchanges to capitalize on price fluctuations. This process can include different strategies such as day trading, swing trading, and arbitrage.

Day trading is a strategy where traders aim to profit from short-term price movements within the same trading day. This approach requires constant monitoring of the market, quick decision-making, and a solid understanding of technical analysis. Tools such as moving averages, Relative Strength Index (RSI), and Bollinger Bands are commonly used to identify potential entry and exit points.

Swing trading, on the other hand, involves holding onto assets for several days or weeks to benefit from expected upward or downward swings. Swing traders focus on identifying broader trends and use chart patterns like head and shoulders, cup and handle, and ascending triangles to predict future price movements. This strategy demands a balance between patience and activity, as it is critical to time the market’s swings accurately.

Arbitrage is another method where traders exploit price differences of the same asset across different exchanges. For example, if Bitcoin is trading at $40,000 on one exchange and $40,200 on another, an arbitrage trader can buy Bitcoin at the lower price and sell at the higher price, pocketing the difference. This strategy generally requires fast execution and a keen eye on the market to identify opportunities before they vanish.

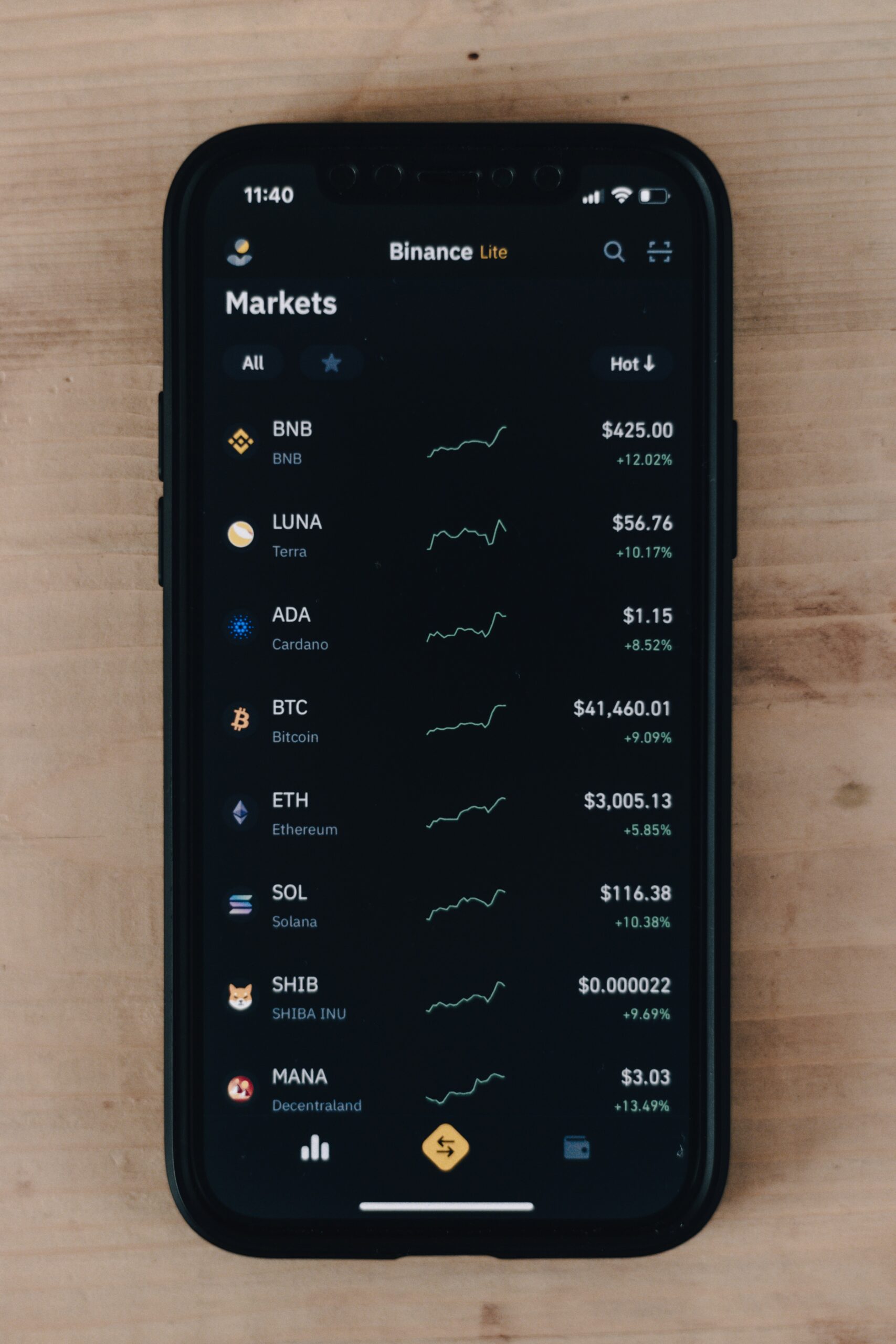

To trade successfully, traders need a robust set of tools and resources. Technical analysis is fundamental, employing charts and indicators to predict price movements based on historical data. Understanding chart patterns is also crucial in identifying potential market trends. Moreover, a reliable and user-friendly trading platform is essential, as it provides real-time data, analysis tools, and secure execution of trades. Platforms like Binance, Coinbase Pro, and Kraken are popular among traders for their comprehensive features and intuitive interfaces.

With the right strategies and tools, trading cryptocurrencies can offer significant profit opportunities by leveraging market volatility. However, it also carries substantial risks, making it imperative for traders to stay informed and exercise prudent risk management.

Mining Cryptocurrencies

Cryptocurrency mining is a process through which new digital coins are created and transactions are validated on a blockchain network. This involves solving complex mathematical problems that require significant computational power. Miners are rewarded with newly minted coins and transaction fees, contributing to the network’s security and integrity.

To begin mining cryptocurrencies, one needs specialized hardware known as mining rigs. The two most popular types of hardware are Application-Specific Integrated Circuits (ASICs) and Graphics Processing Units (GPUs). ASICs are designed specifically for mining and offer high efficiency and performance for specific cryptocurrencies like Bitcoin. GPUs, on the other hand, are versatile and can mine a variety of cryptocurrencies, such as Ethereum, but might offer lower performance compared to ASICs when used for the same function.

In addition to hardware, mining also requires appropriate software. This software connects your mining rig to the cryptocurrency network and allows you to join mining pools. These pools are groups of miners who combine their computational power to increase the chances of solving a block and receiving rewards. Popular mining software includes CGMiner, BFGMiner, and EasyMiner, each offering different features and compatibility with specific hardware.

Bitcoin and Ethereum are among the most well-known cryptocurrencies that can be mined; however, there are many others, including Litecoin, Monero, and Zcash. Each cryptocurrency has its own mining algorithm and difficulty level, affecting the mining process and potential profitability. Factors such as electricity costs, hardware maintenance, and the cryptocurrency’s market value also play crucial roles in determining profitability.

The rewards obtained from mining can be substantial, but it’s important to acknowledge the considerable initial investment and ongoing costs involved. Additionally, as the difficulty of mining increases over time, the potential returns may diminish, making it essential to continually evaluate the cost-effectiveness of mining operations.

Staking and Yield Farming

In the evolving landscape of cryptocurrency, staking and yield farming have emerged as prominent methods for earning passive income. Staking involves the process of actively participating in network operations by locking up a certain amount of cryptocurrency. In return for securing and validating transactions on the blockchain, users are rewarded with additional tokens. This mechanism is commonly used in Proof-of-Stake (PoS) and its variants, which offer an alternative to the energy-intensive Proof-of-Work (PoW) systems.

Staking provides an opportunity for crypto holders to earn rewards while contributing to the security and efficiency of blockchain networks. The rewards vary depending on the blockchain protocol, the amount staked, and the duration of the staking period. Popular cryptocurrencies that support staking include Ethereum 2.0 (ETH), Cardano (ADA), and Polkadot (DOT), offering varying reward rates that can be attractive for long-term investors.

Yield farming, on the other hand, is a more complex and potentially lucrative approach to generating returns in the crypto market. Yield farming involves lending cryptocurrencies through decentralized finance (DeFi) protocols in order to generate interest or additional tokens. Platforms like Uniswap, Compound, and Aave have become popular for their lucrative yield farming opportunities. In essence, users provide liquidity to various pools and are compensated with returns through interest or rewards.

Both staking and yield farming carry their own set of risks and rewards. Staking is generally considered more stable, as it involves reputable networks and a clear reward structure. However, the value of staked assets can fluctuate, impacting potential returns. Yield farming, while potentially offering higher returns, carries a heightened level of risk due to market volatility, smart contract vulnerabilities, and the nascent nature of DeFi platforms. Furthermore, the liquidity of assets in yield farming protocols can be affected by rapid changes in utilization and interest rates.

Platforms supporting staking and yield farming are evolving rapidly, offering diverse opportunities and mechanisms to maximize returns. It is crucial for individuals to conduct thorough research and consider their risk tolerance before participating in these ventures. Understanding the mechanics, rewards, and potential pitfalls of each strategy is essential for making informed decisions in the pursuit of passive income in the crypto market.

Initial Coin Offerings (ICOs) and Token Sales

Initial Coin Offerings (ICOs) and token sales emerge as significant avenues for generating profit in the crypto market. An ICO is a form of crowdfunding where new cryptocurrency projects raise funds by issuing their own tokens in exchange for established cryptocurrencies like Bitcoin or Ethereum. These tokens often grant access to the new service or product developed by the project, and, in some cases, may appreciate in value, offering lucrative returns to participants.

To participate in an ICO, investors typically need to register on the project’s website, provide some personal information, and send their contribution—usually in the form of established cryptocurrencies—to a designated address. The project then issues tokens to the investors as a receipt of their contribution. Token sales usually follow a similar process and can involve pre-sale events where early participants may receive bonuses or discounts.

However, it is crucial to approach ICOs and token sales with caution due to the inherent risks involved. The lack of regulation in the crypto market means there is a high prevalence of scams and fraudulent schemes. Investors must conduct thorough due diligence before committing their funds to any project.

To evaluate potential ICOs, consider the following tips:

1. Assess the Team: Review the backgrounds of the team members and advisors. Check for previous successful projects and relevant experience in the industry.

2. Study the Whitepaper: The whitepaper should clearly outline the project’s goals, technology, use cases, and roadmap. A well-prepared document reflects the project’s legitimacy.

3. Community and Social Media Presence: Active engagement with a strong community can be an indicator of the project’s credibility. Look for transparent communication and regular updates on social media and forums.

4. Analyze the Tokenomics: Understand the distribution of tokens, the allocation of funds, and the project’s financial plan. Ensure there are mechanisms to prevent excessive dilution of token value.

By adhering to these guidelines and remaining vigilant, investors can mitigate risks and maximize their chances of profitability in the exciting but volatile landscape of Initial Coin Offerings and token sales.

Earning Through Crypto Lending and Borrowing

Crypto lending and borrowing represent one of the dynamic avenues through which investors can earn interest on their digital assets. This method involves lending out cryptocurrencies through various platforms to earn periodic interest, just like a traditional bank deposit, but often with significantly higher yields. The process of crypto lending generally starts with users choosing a lending platform, depositing their cryptocurrency, and then the platform either lending out these funds to borrowers or staking them in decentralized finance (DeFi) protocols.

Several types of platforms facilitate crypto lending, each with its unique features and mechanisms. Centralized platforms, such as BlockFi and Celsius, operate similarly to conventional financial institutions and manage the lending and borrowing operations on behalf of users. These platforms often offer more streamlined services and customer support but require trust in the provider since they hold users’ assets. On the other hand, decentralized lending platforms like Aave and Compound operate on blockchain technology using smart contracts, eliminating intermediaries and allowing for automated, trustless interactions directly between users.

The potential benefits of crypto lending are multifaceted. Investors can earn higher interest rates compared to traditional banking systems, which can provide a steady income stream, particularly when market conditions are favorable. Additionally, by lending out idle assets, users can maximize the utility of their holdings. However, crypto lending does come with notable risks. These include counterparty risk, where the borrower may default, and platform risk, where the platform itself may face technical vulnerabilities or operational failures. Investors need to conduct thorough due diligence on the lending platform’s security measures, interest rate conditions, and insurance policies before engaging their funds.

Moreover, borrowing against crypto assets allows users to leverage their cryptocurrency holdings without liquidating them. Borrowers can collateralize their assets in exchange for fiat or stablecoin loans, thus maintaining their market position while gaining liquidity for other investments or personal needs. This approach can be particularly advantageous in a bullish market, where the value of the collateral might appreciate over time. However, borrowers should be mindful of the loan-to-value (LTV) ratios and the potential for margin calls if the market turns bearish, requiring additional collateral or risking liquidation.

In essence, crypto lending and borrowing can be a lucrative means to generate passive income or access liquidity, but it demands a careful understanding of the risks involved and a strategic approach to mitigate those risks effectively.

Risks and Challenges in the Crypto Market

Investing in the cryptocurrency market can be highly lucrative but is fraught with numerous risks and challenges. One of the most significant issues is market volatility. Cryptocurrencies are known for their dramatic price swings. A single tweet from a key industry player or a regulatory announcement can cause prices to soar or plummet within minutes. This high level of unpredictability makes strategic investment planning difficult and increases the potential for substantial financial loss.

Another critical challenge is the regulatory uncertainty surrounding cryptocurrencies. Regulatory environments vary significantly from one country to another, and what is legal in one jurisdiction might be illegal in another. For instance, while some countries have embraced crypto assets and formulated beneficial laws, others have imposed strict regulations, posing a constant risk to investors. This uncertainty can lead to abrupt changes in market dynamics, adversely affecting investors and potentially leading to severe losses.

Security is a paramount concern in the cryptocurrency market. The digital nature of these assets makes them susceptible to cyber threats such as hacking and phishing attacks. High-profile security breaches at exchanges and wallets have resulted in the loss of millions of dollars. While blockchain technology itself is highly secure, the platforms that facilitate trading and storage may not offer the same level of protection.

Potential loss of funds is an ever-present risk in the volatile crypto environment. Unlike traditional banking systems, cryptocurrency investments are typically not insured, meaning that if you lose your funds, you have no recourse for recovery. Additionally, the irreversible nature of blockchain transactions adds another layer of risk. Once a transaction is completed, it cannot be undone, and any error can lead to permanent loss.

Given these challenges, effective risk management is crucial. Diversifying investments across different cryptocurrencies can mitigate the risk of significant loss. It’s also advisable to stay informed about regulatory changes and to use reputable platforms with robust security measures. Adopting a long-term investment strategy rather than speculative trading can also reduce the impact of market volatility.